One way to increase ROE is to decrease equity. ROA measures the efficiency of operating management.

Dupont Identity Of Return On Equity Roe This Breaks Roe Into Profit Margin Total Asset Turnove Return On Equity Accounting And Finance Financial Management

Financial leverage means using someone elses money instead of equity for part of the capital of a business.

. Return on Assets ROA is a type of return on investment ROI metric that measures the profitability of a business in relation to its total assets. ROE measures the efficiency of capital or financial management. You buy a building for 20 million and rent it out for 2 million per year.

Return on equity shows how well a company uses investment funds to generate earnings growth. ROE and ROA are important components in banking for spread corporate performance. We can summarize the exact relationship among ROE ROA and leverage in the following equation1.

ROE on the other hand looks at how effectively a bank or any business is using shareholders equity. Figure 3 shows the percentage of KFMA farms where ROA is greater than ROE for three different time spans. Discuss how financial leverage explains the difference between ROA and ROE.

The ROA is similar to the ROCE ratio in that it measures profitability and financial efficiency. This is the key difference between ROA and ROI. ROA is a useful ratio for interpreting profit performance aside from determining financial gain or loss.

The green line is just for cases where the. ROA is a capital utilization test how much profit before interest and income tax was earned on the total capital employed by the business. The formula for calculating shareholders equity is Asset of the company Debt.

One major difference between ROE and ROA is debt. In this case the numerator of ROE has tax removed and there is no interest but the denominator will be the same no debt so the ROCE will be bigger. Table of Contents Return on Equity ROE.

Return on equity ROE helps investors gauge how their investments are generating income while yield on assets ROA helps investors measure how management is using its assets or resources to generate more income. Discuss how financial leverage explains the difference between ROA and ROE. This means that the net income and return on.

Analyze your companys performance for three of the eight years in comparison to one of your competitors. ROA Return On Assets calculates how much income is generated as a proportion of assets while ROI Return On Investment measures the income generation as opposed to investment. If its ROA exceeds the interest rate then its ROE will exceed 1 minus the tax.

Overview and Key Difference 2. The difference is that the ROA ratio focuses specifically on the efficient use of assets. ROE represents the companys financial performance or the money that the company makes based on the individuals total ownership stake.

ROA summary graph from the Annual Report into your report to support your data. A higher ROE is not always an indicator of an impressive. If there is no debt or if the firms ROA equals the interest rate on its debt its ROE will simply equal 1 minus the tax rate times ROA.

Under DuPont analysis return on equity is equal to the profit margin multiplied by asset turnover multiplied by financial leverage. The final test is how much profit was made on. And the amount of financial leverage Financial Leverage Financial leverage refers to the amount of borrowed money used to purchase an asset with the expectation that the income from the new asset will exceed the cost it has.

Its important to understand so that you can make good decisions when investing and more importantly track the performance of your investments so you know when to continue with an investment or move along. The relationship has the following implications. Debt is included in ROA which can be clearly seen in the balance sheetTotal Assets Liabilities Shareholders Equity 3.

Their equity investment is fully at risk compared to other sources of funds supporting the bank. A higher ROI and ROE is better. The basic idea is that it takes money assets to make money profit.

The Difference Is All About Liabilities The big factor that separates ROE and ROA is financial leverage or debt. Shareholders are the last in line if the going gets rough. Many observers like ROE since equity represents the owners interest in the business.

It measures a firms efficiency at generating profits from every unit of shareholders equity. By splitting ROE return on equity into three parts companies can more easily understand changes in their ROE over time. In 2013 banking superhuman Bank of America Corp.

A high degree of financial leverage implies that a company has high levels of interest payments which could negatively impact its net income bottom-line earnings per share as well as return on equity ROE. The major factor that separates ROE and ROA is financial leverage ie. Beyond that do you understand the major details and differences between the two measurements.

ROE Return on Equity is basicly profit divided by equity. Return on equity is the rate of return on the shareholders equity of a companys common stock owners. This means that in this scenario ROE and ROA will be equal.

Profit Margin Profit margin is a measure of profitability. The balance sheets fundamental equation shows how this is. Comparing ROA to ROE Because ROA can be greater than ROE due to unpredictable weather and prices a longer term trend of ROA greater than ROE is used to see if it can help predict loan problems.

If there is no debt shareholders equity and total assets of the company will be same. However financial leverage really increases the variability of a companys net income and its return on equity. Consider a zero debt situation.

ROE summary graph from the Annual Report into your report to support your data. Now if the company decides to take a loan ROE would become greater than ROA. It can be calculated using the following equation.

ROE is Net Earnings over Shareholders Equity. For example imagine a simple business. The formula to calculate ROE is net income divided by shareholders equity.

ROA and ROI are two vital measures that can be used in this exercise. So equity capital tends to be. Components of the DuPont Equation.

ROCE is Earnings before Interest and Tax over Capital Employed Shareholders Equity plus Debt financing.

Using Dupont Formula For Company Roa And Roe Analysis Daniel

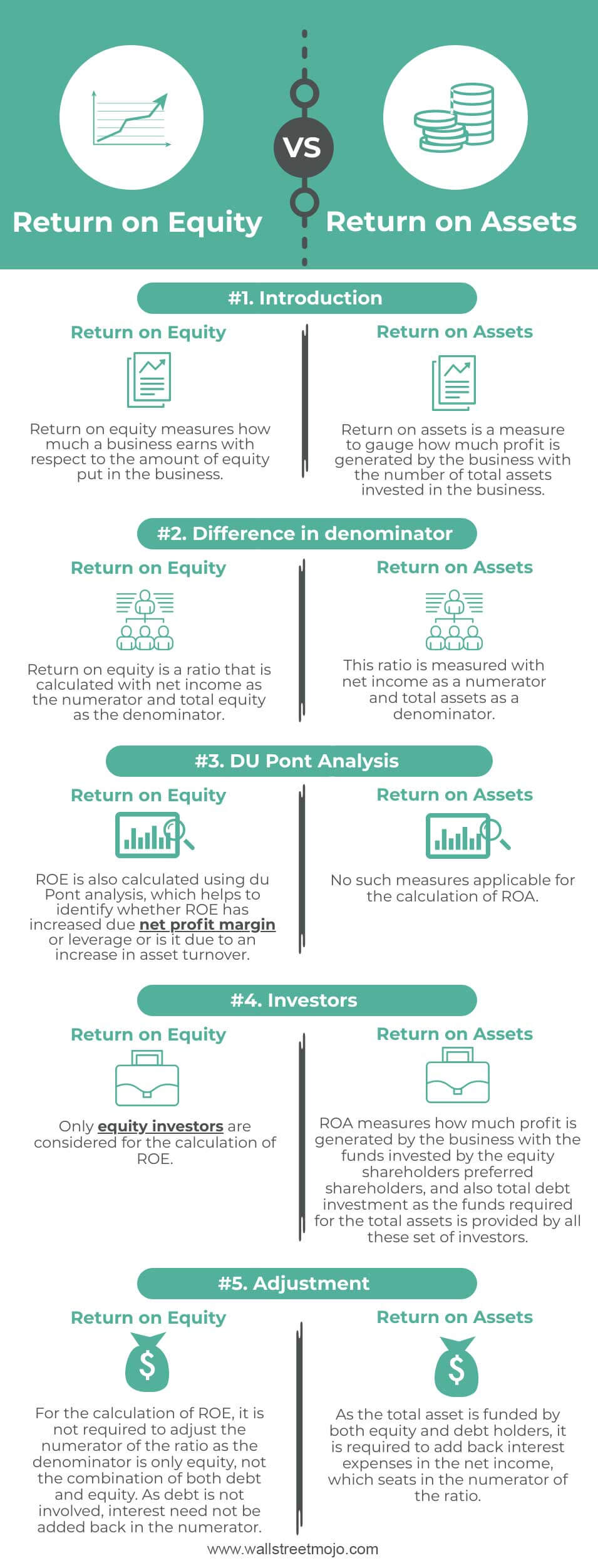

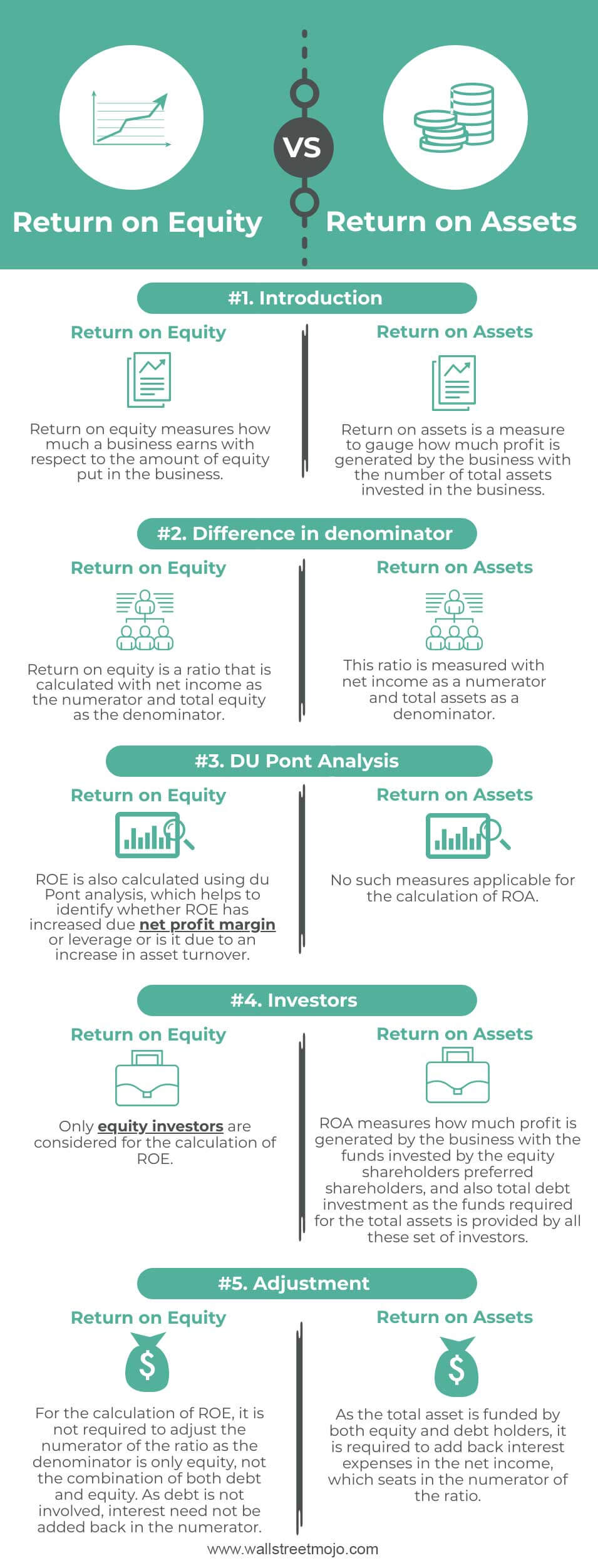

Roe Vs Roa Top 5 Differences With Infographics

Consultantsmind Dupont Model Roe Return On Equity Financial Statement Analysis Marketing Analysis

Using Dupont Formula For Company Roa And Roe Analysis Daniel

0 Comments